Abu Dhabi is the capital of the United Arab Emirates.

It is also the capital of the Emirate of Abu Dhabi and the centre of the Abu Dhabi Metropolitan Area.

Abu Dhabi’s rapid development and urbanization, coupled with the massive oil and gas reserves and production.

Relatively high average income, have transformed it into a large, developed metropolis.

It is also the country’s center of politics and industry, and a major culture and commerce center.

Abu Dhabi accounts for about two-thirds of the roughly $503 billion UAE economy.

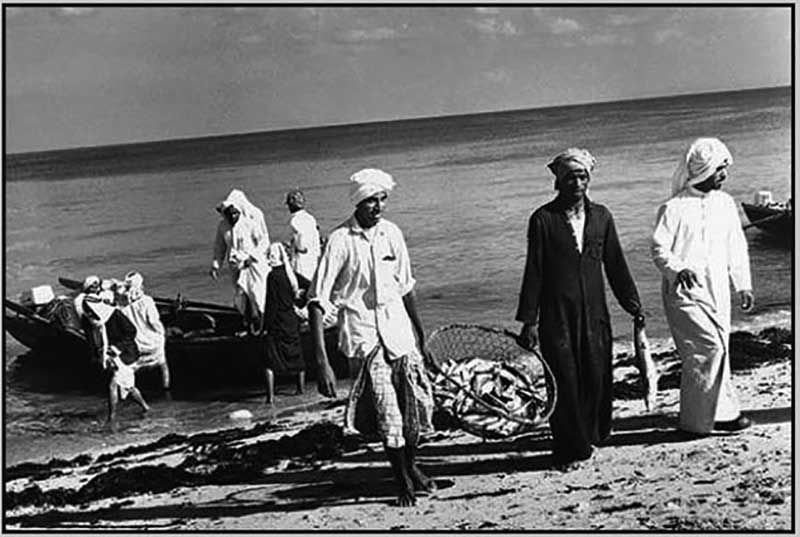

Pearl trade in Abu Dhabi

The pearl diving business was a key industry prior to the discovery of oil reserves.

According to a source about pearling, the Persian Gulf was the best location for pearls.

Pearl divers dive for one to three minutes and would have dived as many as thirty times per day.

While the divers had a leather nose clip and leather coverings on their fingers.

As well as big toes to protect them while they are searching for oysters.

Oil discoveries led to a huge economic transformation.

In the mid to late 1930s, as the pearl trade declined, interest grew in the oil possibilities of the region.

On 5 January 1936, “PDTC the Iraqi Petroleum Company” entered into a concession agreement with the ruler, Sheikh Shakhbut bin Sultan Al Nahyan.

In order to explore for oil.

A seventy-five-year concession signed in January 1939 followed the concession agreement.

A seventy-five-year concession signed in January 1939 followed the concession agreement.

However, owing to the desert terrain, inland exploration was fraught with difficulties.

In 1953, D’Arcy Exploration Company, the exploration arm of BP, obtained an offshore concession.

Which was then transferred to a company created to operate the concession.

Abu Dhabi Marine Areas (ADMA) was a joint venture between BP and Compagnie Française des Pétroles (later Total).

In 1958, using a marine drilling platform, the ADMA Enterprise, oil was struck in the Umm Shaif field at a depth of about 2,669 metres (8,755 ft).

This was followed in 1959 by PDTC’s onshore discovery well at Murban No.3.

In 1962, the company discovered the Bu Hasa field and ADMA followed in 1965 with the discovery of the Zakum offshore field.

Today, in addition to the oil fields mentioned, the main producing fields onshore are Asab, Sahil and Shah.

While offshore fields are al-Bunduq, and Abu al-Bukhoosh.

Abu Dhabi owns 95% of hydrocarbon resources.

The UAE’s large hydrocarbon wealth gives it one of the highest GDP per capita in the world.

Because Abu Dhabi owns the majority of these resources—95% of the oil and 92% of gas.

Abu Dhabi thus holds 9% of the world’s proven oil reserves (98.2bn barrels).

And almost 5% of the world’s natural gas (5.8 billion cubic metres or 200 billion cubic feet).

As of April 2022 oil production in the UAE was about 3.0 million barrels per day (BPD).

In recent years, the focus has turned to gas as increasing domestic consumption for power.

Desalination and reinjection of gas into oil fields increases demand.

Adnoc Gas Supplies Liquefied Natural Gas to Japex for 5 Years.

Gas extraction is not without its difficulties.

However, as demonstrated by the sour gas project at Shah where the gas is rich in hydrogen sulfide content and expensive to develop and process.

Non-oil and gas GDP now constitutes 64% of the UAE’s total GDP.

This trend is reflected in Abu Dhabi with substantial new investment in industry, real estate, tourism and retail.

Since Abu Dhabi is the largest oil producer of the UAE, it has reaped the most benefits from this trend.

It has taken on an active diversification and liberalization program to reduce the UAE’s reliance on the hydrocarbon sector.

This is evident in the emphasis on industrial diversification.

As well as the completion of free zones, Industrial City of Abu Dhabi, twofour54, Abu Dhabi media free zone and the construction of another, ICAD II, in the pipeline.

There has also been a drive to promote tourism and real estate with the Abu Dhabi Tourism Authority.

The Tourism and Development Investment Company undertaking several large-scale development projects.

Abu Dhabi’s Emirate is the wealthiest of the UAE in terms of Gross domestic product (GDP) and per capita income.

More than $1 trillion is invested worldwide in the city.

In 2010, the GDP per capita reached $49,600, which ranks ninth in the world.

Taxation in Abu Dhabi, as in the rest of the UAE, is nil for a resident or a non-bank, non-oil company.

The Emirate is also planning many future projects sharing with the Cooperation Council for the Arab States of the Gulf (GCC).

By taking 29% of all the GCC future plannings.

Abu Dhabi’s sovereign wealth fund, ADIA, currently estimated at $875 billion.

Which is the world’s wealthiest sovereign fund in terms of total asset value.

Abu Dhabi’s government is looking to expand revenue from oil and gas production to tourism and other things to attract different types of people.

This goal was clear in the amount of attention Abu Dhabi is giving its International Airport.

The airport experienced a 30%+ growth in passenger usage in 2009.

Also Abu Dhabi Economic Vision 2030 planned by the Abu Dhabi Urban Planning Council shows the idea of diversifying the economy.

In this plan, Abu Dhabi’s economy will be sustainable and not dependent on any single source of revenue.

More specifically the non-oil portion of income is planned to be increased from about 40% to about 70%.

As of July 2019, Abu Dhabi allocated $163 million to finance global entertainment partners as part of its plan to diversify the economy and wean it off oil.

Many Hollywood and other national film production teams have used parts of the UAE as filming locations.

In recent years Abu Dhabi has become a popular destination.

The Etihad Towers and Emirates Palace Hotel, some of the city’s landmarks used as filming locations for the movie Furious 7.

In which cars rush through the building and smash through the windows of the towers.

And lately, New Abu Dhabi Airport Terminal was the shooting location for Mission: Impossible – Dead Reckoning Part One.

In 2018, Abu Dhabi launched Ghadan 21, a string of initiatives to diversify the economy.

There are four main areas these initiatives must fall under business and investment, society, knowledge and innovation and lifestyle.

The first phase includes over 50 initiatives that reflect the priorities of citizens, residents and investors.

Read More: